UK Residential Market: Outlook for 2024

Article written by:

Megan HillAs we enter 2024, a retrospective glance at the UK residential market in 2023 reveals a nuanced landscape. Instead of analysing the statistical intricacies, let's dissect the data to uncover the insights it holds. This exploration will not only shed light on the UK residential market in the past but also pave the way for projecting the trends and challenges that will shape it in the coming year.

2023 Context

The concluding quarter of 2023 witnessed a modest uptick in house prices, registering a 0.2% growth, according to data from Halifax. However, it's crucial to dissect this growth – a closer inspection reveals that the impetus behind this increase was primarily a consequence of a scarcity of available properties rather than a surge in sales demand.

Outlook for 2024

Despite the hurdles faced by potential buyers in 2023, the marginal increase in house prices suggests a rekindled confidence in the residential market. This sentiment may well gain momentum in 2024. However, regional disparities come to the forefront, with areas in the south-east of England experiencing a pronounced decline in prices, plummeting by 4.5%.

The overarching theme for 2024 remains one of heightened market uncertainty, characterized by subdued buyer and seller activity. Forecasts paint a picture of a continued descent in house prices throughout the year. The ebb and flow of the market hinge on several elements, with mortgage and inflation rates, alongside the supply of housing stock, standing out as pivotal factors.

What will happen to mortgage rates?

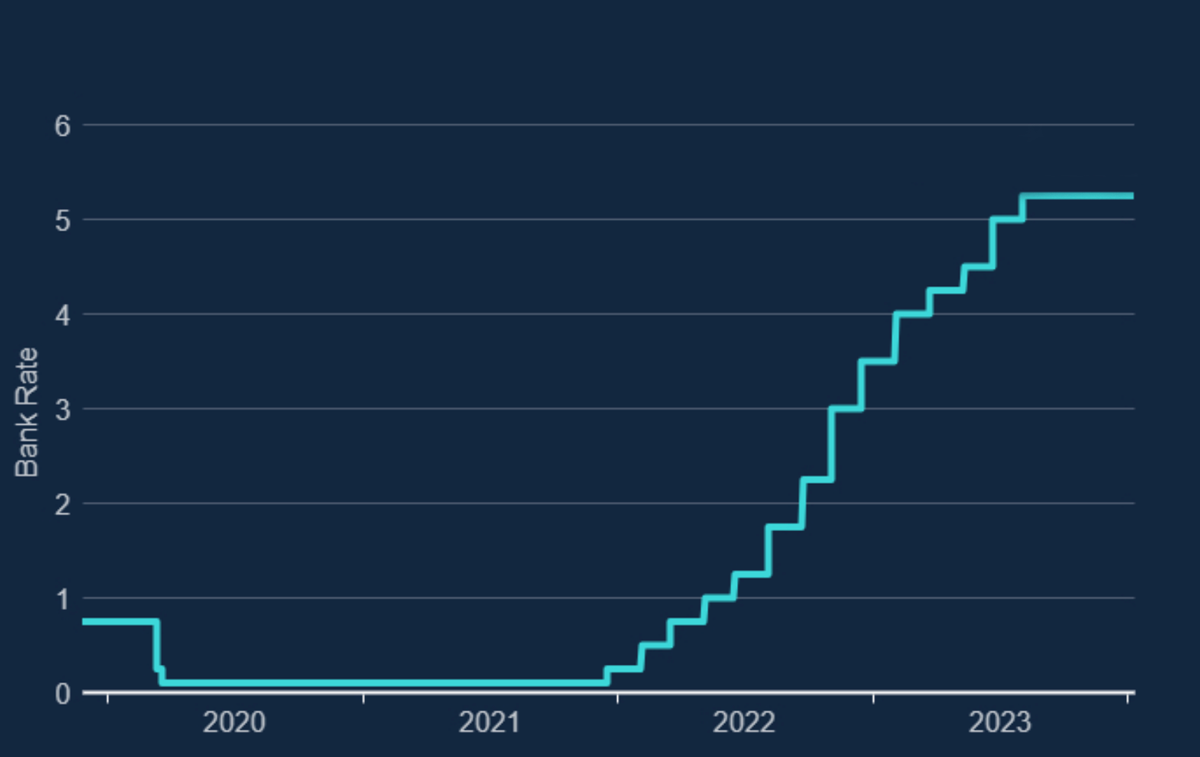

The Bank of England projects that around 900,000 borrowers could witness a monthly mortgage repayment increase of over £500 as lower fixed-rate deals reach their conclusion this year. Although mortgage rates exhibited a decline in the latter half of 2023, substantial drops are challenging to predict.

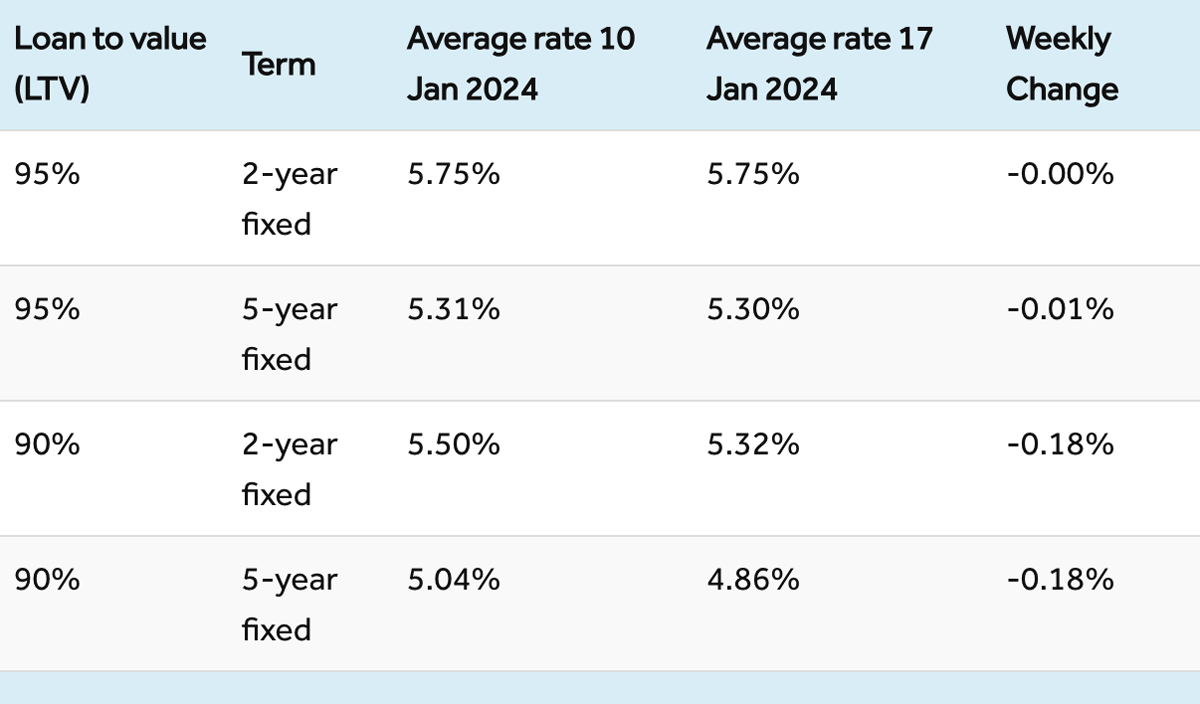

Average fixed-term mortgage rates for home-buyers with 5-10% deposits

(Source: Rightmove)

While the Bank of England base rate is expected to remain at 5.25% until late 2024, the prospect of a substantial reduction in mortgage rates remains uncertain. Despite these potential decreases, a lingering lack of buyer confidence persists. Consequently, the forecast suggests that until base rates fall, house prices are likely to continue their descent due to the imbalance of supply and demand in the market.

Official Bank of England base rate (Source: Bank of England)

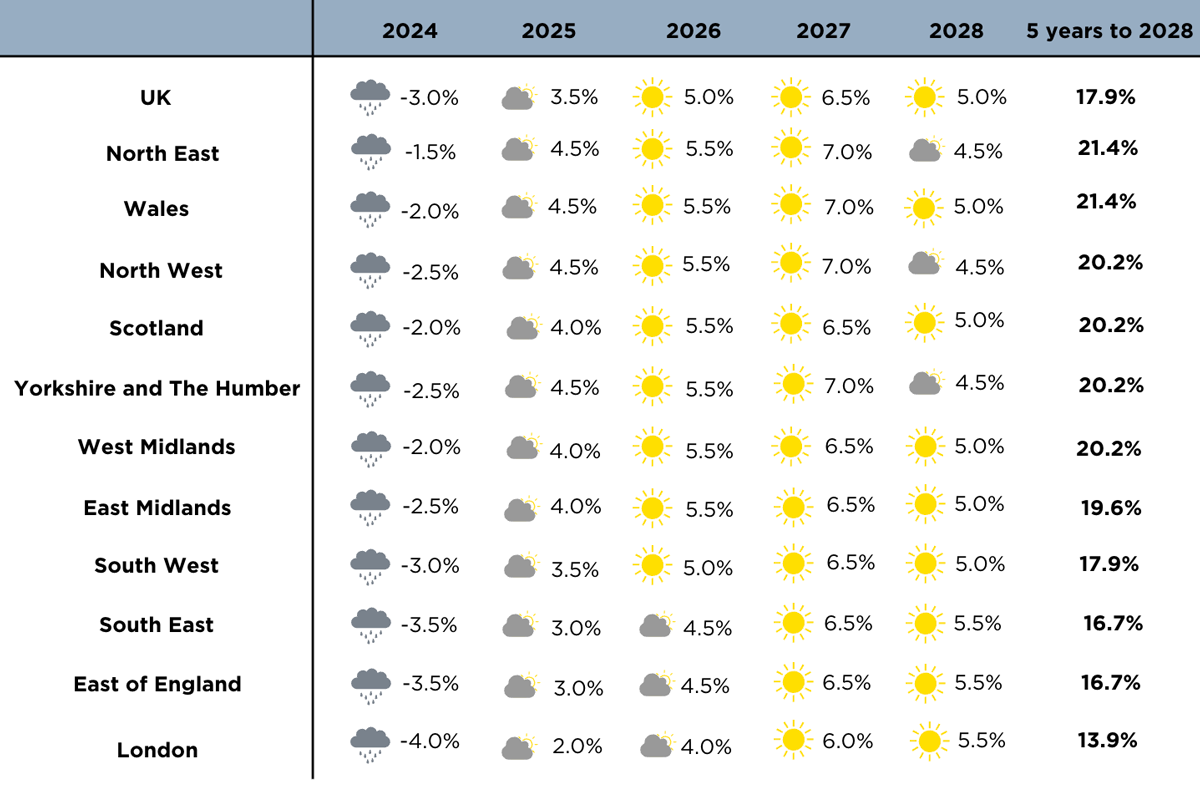

Value forecasts - Savills

Savills research offers valuable insights, indicating that property values across the UK are poised for a decline throughout 2024-25, with a subsequent upward trajectory anticipated in 2026 for most regions. Notably, the South-East and East of England, along with London, may continue to experience drops in property values throughout 2026.

Mainstream capital value forecast (Source: Savills Research)

Note: These forecasts apply to average prices in the second-hand market.

New build values may not move at the same rate.

Conclusion

As we navigate the intricate landscape of the UK residential market in 2024, uncertainties abound. RCA Regeneration, with its commitment to efficient processes and consistent delivery, stands poised to provide strategic insights and expert advice in this dynamic environment. For clients seeking a partner with a proven track record in planning and development consultancy, RCA Regeneration remains a steadfast choice.

How can we help?

RCA Regeneration produces robust market assessments to inform options for the development of sites and to support financial viability appraisals. Our team of experts is ready to guide you through the complexities of the planning and development process.

References:

Making Hay While the Sun Shines

We now find ourselves experiencing a mix of weird dreams, unsettled nights, gorgeous weather, home working, home schooling, social distancing, fear for our loved ones...

RCA expands into the east of England

Due to significant growth of the business and increasing opportunities within Cambridgeshire and Norfolk, RCA Regeneration Ltd. have recently expanded into the east of...

Making Representations to the Plan-Making Process

Well we’re now into a new year and new decade and the RCA team have been reflecting on the most recent consultation season at the end of 2019. At the end of the year,...

Planning Enforcement updates

We’ve been a bit quiet on enforcement matters to date, but you may not know we love a good enforcement case! Over the last year or so we’ve been working ‘both sides of...

The Draft Revisions to the NPPF in Under 90 Seconds

On Saturday morning (30/01/2021), MHCLG released an open consultation on some proposed revisions to the National Planning Policy Framework (NPPF) as well as a new draft...

RCA's response Levelling-up and Regeneration Bill: Reforms to National Planning Policy

We’ve responded to the National Planning Policy Framework consultation.

This representation is made by RCA Regeneration Ltd in respect of the “Levelling-up and...

Leave a Comment